Order Management

The Order Management module of TheBooks provides the tools you need to manage the order entry and trading activity notification process. It handles all of the paper work and communication associated with placing and reporting trades, leaving you with more time to research and trade your strategies..

Order entry, placement and management

Orders can be entered through the user interface, loaded from files, created via our API, or automatically generated as the result of FIX drop copy trade capture.

TheBooks supports futures, forwards, FX, Swaps, Equities and options on all of these as well as power contracts. Both day trades and GTC orders are supported. There’s also an API you can use to enter orders directly from your order generator into the Order Management module from anywhere in your network. When you place the order, the Order Management module automatically sends a breakdown to the execution desk or into the market or to a trading platform if an execution gateway is installed.

Trade Sizing

Each account in TheBooks has a trading size (sometimes called trading level) which is independent of the accounts equity level. One of the primary uses for trading size is to assist in order sizing.

The table below details how each of the methods work:

| Contracts per million of trading size | Each account in a block trade is assigned a number of contracts based on a specified number of contracts per million of trading size |

| Fixed order size | Each account in a block is given their relative portion of the total quantity based on their trading size as a portion of the total trading size of accounts within the block |

| Target level | First the number of contracts that each account should get is determined based on the Contracts per million method. Then, TheBooks looks at how many contracts the accounts within the block actually have on and sizes the trade such that if the trade is fully filled, the accounts will have the specified number of contracts per million as open positions. |

| User-defined | Both the user interface and the programming interface have facilities to allow the user to specify exactly the number of contracts each account is to receive. |

In addition to these methods, TheBooks provides complete support for trading systems (sometimes known as strategies) and allows you to build trades that have components from multiple systems, going is opposite directions if needed.

Fill Entry and Allocation

When block trades are filled with multiple fill prices, the issue of allocating fill prices amongst the accounts which make up the block become paramount. NFA rules state that the allocation process used by an advisor must be "Fair and Consistent."

TheBooks provides the advisor several options to choose from when deciding how the firm should perform these allocations:

Low price to low account number

Low price to high account number

Weighted average (each account gets a mixed fill with an average close to the trades average)

APS for those markets that allow it

In addition to these, TheBooks allows you to indicate that one or more accounts should always receive the worst fills. This is particularly important if you are trading proprietary money within the same trades as your investor's money. Using this option ensures that your investors always get the best fills.

Execution Gateway

Execution Gateways extend the Trading Desk concept in TheBooks and allows the routing of trades directly to exchanges for execution. As trades are filled, they are automatically updated in TheBooks and for those gateways that have an associated trading platform, trades can be worked from within the platform; TheBooks automatically records your actions.

Advanced execution options

TheBooks provides several advanced execution options tailored to systematic institutional advisors:

Iceberged limit orders

Virtual trading days

Custom handling of blown stops on order release

MOO and MOC gap handling

Automatic email alerting of order status when trigger prices are reached

Electronic Give-up

When the trade is complete, TheBooks performs price allocation to the accounts which make up the trade and give-up and breakdown information is passed electronically to the clearing brokers, providing seamless execution and reporting of the trade.

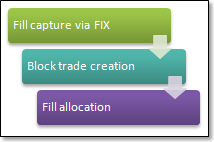

FIX Drop Copy

As trading occurs, fills, regardless of source, can be automatically routed to TheBooks

via FIX connections. Fills for each ticket are consolidated into trades within TheBooks

and are typically booked to what is known as a holding account.

As trading occurs, fills, regardless of source, can be automatically routed to TheBooks

via FIX connections. Fills for each ticket are consolidated into trades within TheBooks

and are typically booked to what is known as a holding account.

After a logical trade has been completed, the trader or back office personnel select the ticket(s) which make up the logical trade and associate them with the group of accounts which are to be assigned to the trade. This process can be performed automatically as well if desired. As an option, the trade can be associated with one or more strategy (or system) to allow tracking of virtual positions and performance by strategy.

Contract quantities are automatically assigned based on the each account’s relative trading size and once saved, quantities and fill prices are allocated to the accounts.

If the advisor wants to work up trades in advance of execution (using TheBooks ability to combine trades from multiple systems/strategies, for example), the assignment of the ticket to the block of accounts can also be done by simply selecting an existing trade rather than specifying a group of accounts. In that case, the fills from the tickets are “pushed” into the existing trade.

Straight-through processing

Whether a trade originates in the trading platform, generated by software, or is manually created in TheBooks, trade processing and reporting is automatically performed.

The goal of complete automation, from trade inception through performance fee calculation is now a reality.

Relationship definition

The Order Management module provides a sophisticated relationship definition tool, allowing you to define the relationships you have with your brokers and clients. You can associate Interested Parties with accounts and specify the frequency of notification (per-trade or daily) and the exchanges the party cares about. Back offices get activity for only those markets they process, minimizing the chances for errors.

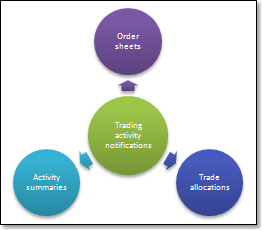

Counter-party notification of trading activity

Counter-party notification of trading activity is used to send trading-specific information to trading desks, back offices, and other organizations that require information about trades that you plan to execute or have executed. As the number of managed accounts you trade increases, the number of counter-parties increase as well. With that comes an increasing number of formats and transmission methods.

TheBooks allows you to to define three broad types of trading activity to send:

Order Sheets, sometimes called breakdowns

These are used to communicate your intention to execute a trade. The most common use of the order sheet is for sending orders to a trading desk. Often, a systematic trader will generate orders at the end of the day for execution the following day. The order sheets are used to transmit these orders to the brokers that will be executing the trade.

Allocations, sometimes called trade tickets

These are used to communicate the quantity/fill price allocation for a filled order back to the executing broker. These tickets provide a written audit trail to ensure that the accounts which make up a block trade are given fills in a fair an consistent manner per your allocation rules.

Activity summaries

These are used to communicate summarized trading information after a trade has been filled. They are often used to provide a daily re-cap of trading activity for a number of accounts to a broker's back office or to some other third party such as accountants or the investor.

These types of data can be sent as reports or as data files. In the case of data files, they are end-user customizable and you can even specify symbology translations if your counter-party uses a different symbology than you do. The reports and/or data files can be emailed or FTPed (FTP, sFTP, FTPs), or sent by a user-written transport method from TheBooks.

Notifications happen automatically as you trade and are sent from the server, leaving your workstation free to monitor markets, perform additional trades, or other activities.